With 2013 just over two hours old, the Senate voted 89-8 on Tuesday to

approve a last-minute deal to avert income tax hikes on all but the

richest Americans and stall painful spending cuts as part of a

hard-fought compromise to avoid the economically toxic “fiscal cliff.”

The country had already technically tumbled over the cliff by the time the gavel came down on the vote at 2:07 a.m.. The House of Representatives was not due to return to work to take up the measure until midday on Tuesday. But with financial markets closed for New Year's Day, quick action by lawmakers would likely limit the economic damage.

The lopsided margin belied anxiety on both sides about the deal, which emerged from barely two days of talks between Vice President Joe Biden and Republican Senate Minority Leader Mitch McConnell. Among the “no” votes: Republican Senator Marco Rubio, widely thought to have his eye on the 2016 presidential race.

In remarks just before the vote, McConnell repeatedly called the agreement “imperfect” but said it beat allowing income tax rates rise across the board.

“I know I can speak for my entire conference when I say we don’t think taxes should be going up on anyone, but we all knew that if we did nothing they’d be going up on everyone today,” he said. “We weren’t going to let that happen.”

“Our most important priority was to protect middle-class families. This legislation does that,” Democratic Senate Majority Leader Harry Reid said. But Reid cautioned that “passing this agreement does not mean negotiations halt. Far from it.”

Compromises on tax rates

Under the compromise arrangement, taxes would rise on income above $400,000 for individuals and $450,000 for households, while exemptions and deductions the wealthiest Americans use to reduce their tax bill would face new limits. The accord would also raise the taxes paid on large inheritances from 35% to 40% for estates over $5 million. And it would extend by one year unemployment benefits for some two million Americans. It would also prevent cuts in payments to doctors who treat Medicare patients and spare tens of millions of Americans who otherwise would have been hit with the Alternative Minimum Tax.

The middle class will still see its taxes go up: The final deal did not include an extension of the payroll tax holiday. And the overall package will deepen the deficit by hundreds of billions of dollars by extending the overwhelming majority of the Bush tax cuts. Many Democrats had opposed those measures in 2001 and 2003. Obama agreed to extend them in 2010.

Efforts to modify the first installment of $1.2 trillion in cuts to domestic and defense programs over 10 years -- the other portion of the “fiscal cliff,” known as sequestration -- had proved a sticking point late in the game. Democrats had sought a year-long freeze but ultimately caved to Republican pressure and signed on to just a two-month delay while broader deficit-reduction talks continue.

Debt-limit battle looms

That would put the next major battle over spending cuts right around the time that the White House and its Republican foes are battling it out over whether to raise the country's debt limit. Republicans have vowed to push for more spending cuts, equivalent to the amount of new borrowing. Obama has vowed not to negotiate as he did in 2011, when a bruising fight threatened the first-ever default on America's obligations and resulted in the first-ever downgrade of the country's credit rating. Biden sent that message to Democrats in Congress, two senators said.

Experts had warned that the fiscal cliff's tax increases and spending cuts, taken together, could plunge the still-fragile economy into a new recession.

Biden, evidently in good spirits after playing a central role in crafting the deal, said little on his way into or out of a roughly one hour and 45 minute meeting behind closed doors with Senate Democrats. "Happy New Year," he said on the way in. Asked on the way out what his chief selling point had been, the vice president reportedly replied: "Me."

Biden's intervention; hurdles in the House

Hours earlier, a Democratic Senate aide told Yahoo News that "the White House and Republicans have a deal," while a source familiar with the negotiations said President Barack Obama had discussed the compromise with Reid and Democratic House Minority Leader Nancy Pelosi and "they both signed off."

But the House’s Republican leaders, including Speaker John Boehner, hinted in an unusual joint statement that they might amend anything that clears the Senate – a step that could kill the deal.

“Decisions about whether the House will seek to accept or promptly amend the measure will not be made until House members -- and the American people -- have been able to review the legislation,” they said.

Biden, a 36-year Senate veteran, worked out the agreement with McConnell after talks between Obama and Boehner collapsed and a similar effort between McConnell and Reid followed suit shortly thereafter. With the deal mostly done, Obama made a final push at the White House.

“Today, it appears that an agreement to prevent this New Year's tax hike is within sight, but it's not done,” Obama said in hastily announced midday remarks at the White House. “There are still issues left to resolve, but we're hopeful that Congress can get it done – but it’s not done.”

"One thing we can count on with respect to this Congress is that if there is even one second left before you have to do what you’re supposed to do, they will use that last second," he said.

Obama’s remarks – by turns scolding, triumphant, and mocking of Congress – came after talks between McConnell and Biden appeared to seal the breakthrough deal.

“I can report that we’ve reached an agreement on all of the tax issues,” McConnell said on the Senate floor moments later. “We are very, very close to an agreement.”

The Kentucky Republican later briefed Republicans on the details of the deal. Lawmakers emerged from that closed-door session offered hopeful appraisals that, after clearing a few last-minute hurdles, they could vote on New Year’s Eve or with 2013 just hours old.

“Tonight, I hope,” Republican Senator Bob Corker of Tennessee told reporters. “It may be at 1, 2, 3, 4 in the morning. Oh, I guess that’s technically tomorrow.”

Reckoning with the 'sequester'

Republican Senators said negotiators were still working on a way to forestall two months of the “sequester” spending cuts, about $20 billion worth. And some expressed disquiet that the tentative compromise ran high on tax increases and low on spending cuts -- while warning that failure to act, triggering some $600 billion in income tax increases on all Americans who pay it and draconian spending cuts, was the worse option.

McConnell earlier had called for a vote on the tax component of the deal.

“Let me be clear: We’ll continue to work on finding smarter ways to cut spending, but let’s not let that hold up protecting Americans from the tax hike,” McConnell urged. “Let’s pass the tax relief portion now. Let’s take what’s been agreed to and get moving.”

House passage was not a sure thing: Both the AFL-CIO labor union and the conservative Heritage Action organization argued against the package.

The breakthrough came after McConnell announced Sunday that he had started to negotiate with Biden in a bid to "jump-start" stalled talks to avoid the fiscal cliff.

Under their tentative deal, the top tax rate on household income above $450,000 would rise from 35 percent to 39.6 percent -- where it was under Bill Clinton, before the reductions enacted under George W. Bush in 2001 and 2003.

Some congressional liberals had expressed objections to extending tax cuts above the $250,000 income threshold Obama cited throughout the 2012 campaign. Democrats were huddling in private as well to work out whether they could support the arrangement.

Obama responds to critics

Possibly with balking progressives in mind, Obama trumpeted victories dear to the left of his party. "The potential agreement that’s being talked about would not only make sure the taxes don’t go up on middle-class families, it also would extend tax credits for families with children. It would extend our tuition tax credit that’s helped millions of families pay for college. It would extend tax credits for clean energy companies that are creating jobs and reducing our dependence on foreign oil. It would extend unemployment insurance to 2 million Americans who are out there still actively looking for a job."

Obama said he had hoped for "a larger agreement, a bigger deal, a grand bargain," to stem the tide of red ink swamping the country’s finances – but shelved that goal.

"With this Congress, that was obviously a little too much to hope for at this time," he said. "It may be we can do it in stages. We’re going to solve this problem instead in several steps."

The president also looked ahead to his next budgetary battle with Republicans, warning that “any future deficit agreement” will have to couple spending cuts with tax increases. He expressed a willingness to reduce spending on popular programs like Medicare, but said entitlement reform would have to go hand in hand with new tax revenues.

“If Republicans think that I will finish the job of deficit reduction through spending cuts alone … then they’ve another thing coming,” Obama said defiantly. “That’s not how it’s going to work.”

“If we’re serious about deficit reduction and debt reduction, then it’s going to have to be a matter of shared sacrifice. At least as long as I’m president. And I’m going to be president for the next four years, I hope,” he said.

The other “no” votes were: Michael Bennet (D-Col.), Tom Carper (D-Del.), Chuck Grassley (R-Iowa), Tom Harkin (D-Iowa), Mike Lee (R-Utah), Rand Paul (R-Ken.), and Richard Shelby (R-Ala.). Republicans Jim DeMint of South Carolina and Mark Kirk of Illinois as well as Democrat Frank Lautenberg of New Jersey did not vote.

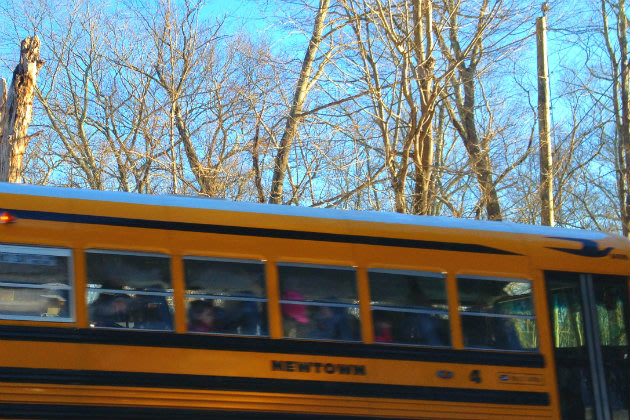

A bus carrying Sandy Hook students arrives at Chalk Hill School. (Dylan Stableford/Yahoo! News)

A bus carrying Sandy Hook students arrives at Chalk Hill School. (Dylan Stableford/Yahoo! News) A sign welcoming Sandy Hook students underneath one pointing to Chalk Hill School. (Dylan Stableford)

A sign welcoming Sandy Hook students underneath one pointing to Chalk Hill School. (Dylan Stableford)